Please Log in or Create an account to join the conversation. EA Tax Form for Malaysia RPCTEAL0 Purpose.

Understanding Lhdn Form Ea Form E And Form Cp8d

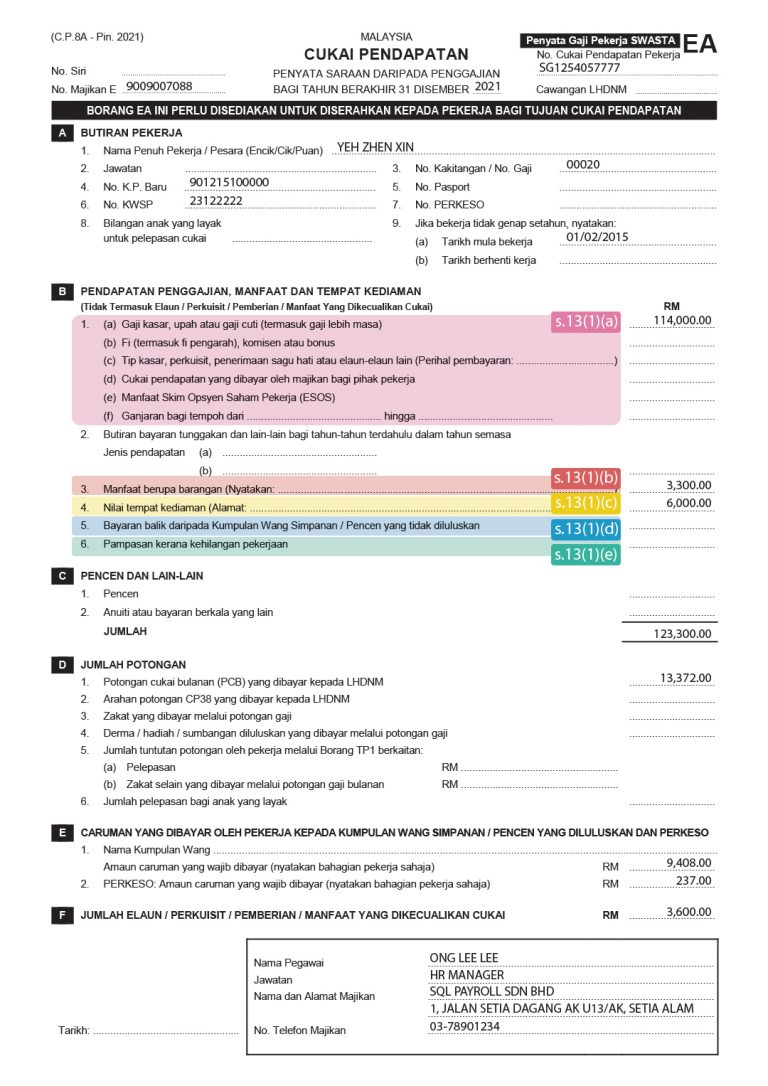

We can also use the EA form to check if we are above the pay grade that requires us to pay taxes.

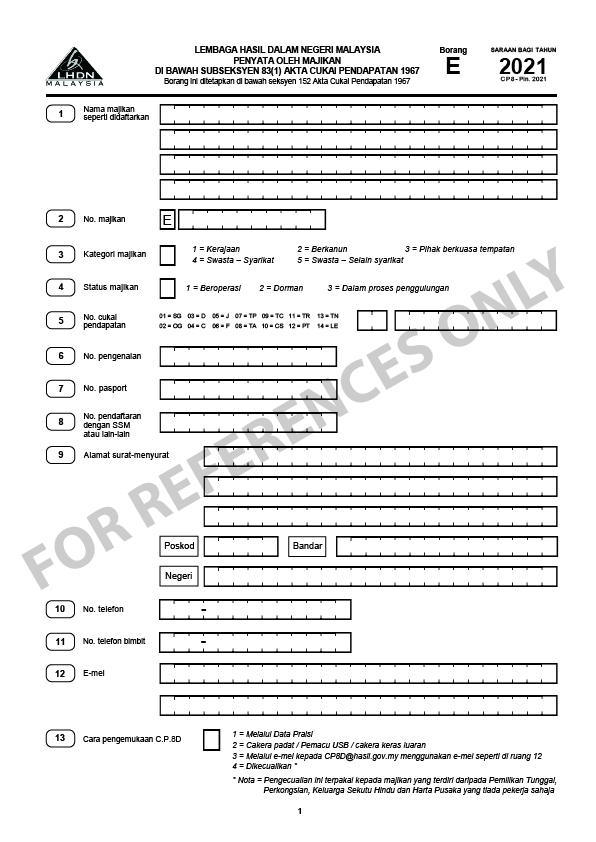

. E 2021 Explanatory Notes and EA EC Guide Notes. 你知道雇主每年的3月31日前都必须将员工的收入与资料E表格呈报给税收局吗 如果你知道了那你是否正确呈报了 在什么情况下应该注册Form E. 3 Via e-mail to CP8Dhasilgovmy by using an e-mail as per item 12 4 Exempted Employers which are Sole Proprietorship Partnership Hindu Joint Family and Deceased Persons Estate who do not have employees are exempted from submitting Form CP8D Note.

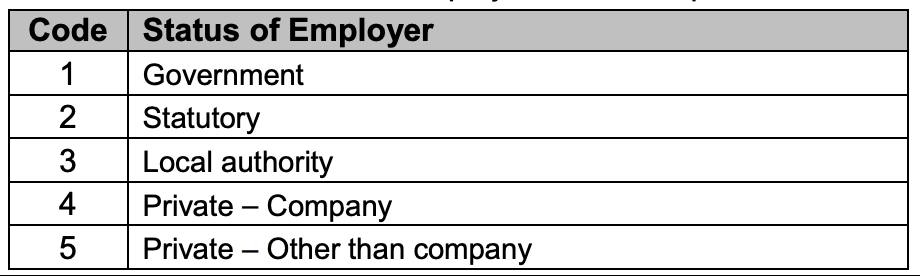

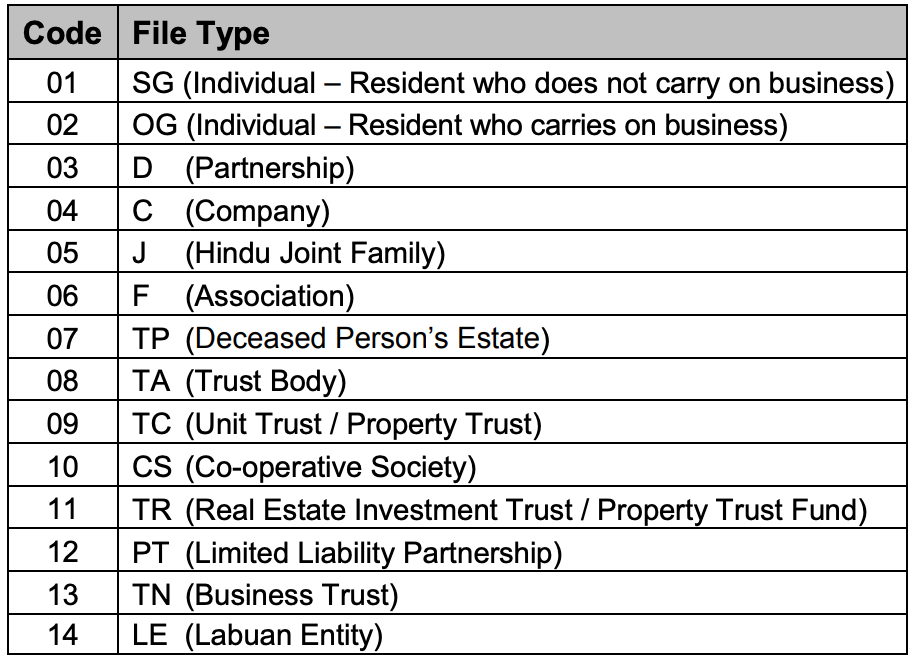

Use the code for relevant employees. Every employer shall for each year furnish to the Director General a return in the prescribed form Click here to read. Failure in submitting Borang E will result in the IRB taking legal action against the companys directors.

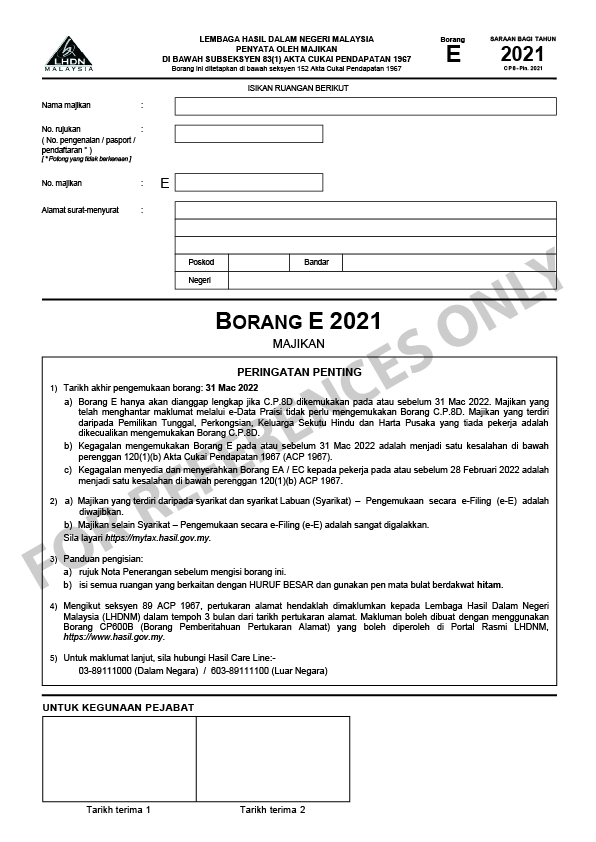

Employers with their own computerised system and many employees are encouraged to prepare CP8D data in the form of txt as per format stated in Part A. Enter 1 for Yes if the employer receives benefit from tax borne by their employer tax allowance. B Failure to furnish Form E on or before 31 March 2021 is an offence under paragraph 1201b of the.

Employers income return is lapsing this 31st March for manual submission. Setiap syarikat mesti mengemukakan Borang E menurut peruntukan seksyen 831 Akta Cukai Pendapatan 1967 Akta 53. Bus and truck companies.

Every employer shall for each year furnish to the Director General a return in the prescribed form Click here to read. As a business in Malaysia youll want to avoid a fine of RM 200 RM 20000 andor a maximum of 6-month imprisonment term under the Income Tax Act Section 1201b. Email confirmation from LHDN.

EA Form for a private sector company. A minimum fine of RM200 will be imposed by IRB for failure to prepare and submit the Form E to IRB as well as prepare and deliver Form EA to the employees. Employers who have e-Data Praisi need not complete and furnish CP8D.

Married and spouse is working divorced or widowed or single with an adopted child. Borang E Form for each employer reference number - This form is a. Individual income tax with no business income is on 30th April 2020.

When declaring our income tax we can use the EA form as a reference to declare the correct amount of annual earnings and deduction. Employer company and Labuan company is compulsory to submit Form E via e-Filing e-E with effect from remuneration for the year 2016. Employers can now easily access all the forms you need when it comes to registration updates and also contribution in one central location.

Form CP22 Notification of new employee. If the prefill data is not submitted before that date the employer is required to submit the CP8D data together with the Form E in the prescribed format or via e-Filing. Form E Borang E is a form that an employer must complete and submit to the Internal Revenue Board of Malaysia IBRM or Lembaga Hasil Dalam Negeri LHDN.

Tax filing for Borang E ie. The Pandan Indah premise has closed. Employers must ensure proper completion of Form I-9 for each individual they.

This report generates the following forms to be filled in by theemployer for filing annual income tax returns of the employees. Employers which are Sole Proprietorship Partnership Hindu Joint Family and Deceased Persons Estate who do not have employees are exempted from submitting Form CP8D. Form E Borang E is a form required to be filled and submitted to Inland Revenue Board of Malaysia IBRM or Lembaga Hasil Dalam Negeri LHDN by an employer.

3 years 3 months ago 2593 by Kap-Chew. Tax Borne by Employer. Basically it is a tax return form informing the IRB LHDN of the list of employee income information and number of employees it must be submitted by March 31 of each year.

All companies Sdn Bhd must submit online for 2018 Form E and. Email confirmation from LHDN. Where can we generate the Borang E in hrmy for LHDN employer submission.

Enter Your Identification No. Please be informed that the Prefill Data System will be closed commencing 22022014. Replied by Kap-Chew on topic Borang E.

Form E will only be considered complete if CP8D is submitted on or. EC Form for a public sector company. All companies Sdn Bhd must submit online for 2018 Form E and.

For your information Pusat Pemprosesan Maklumat LHDNM is now at Seksyen 9 of Bandar Baru Bangi. Married and unemployed spouse. Hi this is not supported yet may be at a later stage.

EA forms are provided by the employer company to their employees. Setiap syarikat mesti mengemukakan Borang E menurut peruntukan seksyen 831 Akta Cukai Pendapatan 1967 Akta 53. Tax filing for Borang BE ie.

3Submit return form of employer Form E together with the CP8D on or before 31 March of the following year. Form E Borang E is a form that an employer must complete and submit to the Internal Revenue Board of Malaysia IBRM or Lembaga Hasil Dalam Negeri LHDN. Essentially its a form of declaration report to inform the IRB LHDN on the number of employees and the list of employees income details and must be submitted by 31st March of each.

如果员工辞职了 公司要通知LHDN吗 让你在一分钟了解 E表格. Dont be part of this statistic for the new year. EA forms are crucial for our personal income tax.

Borang E 2021 PDF Reference Only. English Version CP8D CP8D-Pin2021 Format. In addition every employer shall for each calendar year prepare and render to.

65392 employers were fined andor imprisoned for not submitting Borang E in the Year of Assessment 2014.

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Payroll Borang E Form 2 Otosection

Ea Form 2021 2020 And E Form Cp8d Guide And Download

Malaysia Tax Guide What Is And How To Submit Borang E Form E The Vox Of Talenox

Payroll Panda Sdn Bhd How To Fill In The Previous Employment Information Form

Ying Group 𝐍𝐨𝐭𝐢𝐟𝐢𝐜𝐚𝐭𝐢𝐨𝐧 Lhdn Has Released 2020 Borang E Facebook

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Malaysia Tax Guide What Is And How To Submit Borang E Form E The Vox Of Talenox

Payroll Borang E Form 2 Otosection

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Malaysia Tax Guide What Is And How To Submit Borang E Form E The Vox Of Talenox

Malaysia Tax Guide What Is And How To Submit Borang E Form E The Vox Of Talenox

Understanding Lhdn Form Ea Form E And Form Cp8d

Payroll Borang E Form 2 Otosection